Build your faith belief foundation

Build your faith belief foundation

Are you looking for answers to life’s most pressing questions?

I’ll help you understand the Bible, while making sense of our mixed up world.

Understand the Bible

Was Noah’s Flood Global?

The Bible says Noah’s Flood inundated the earth. However, does that mean the entire planet or just a region of land? We discuss God’s definition, including the Hebrew word.

Does God Appoint Leaders?

Our nations are continually led by corrupt leaders, if only someone else was in office we think. Yet, without turning to God, nothing will change for the better.

Ask a question

The 7 Year Tribulation

The 7 year Tribulation identifies the time when Satan and his angels are cast from Heaven to earth. Though it was originally 7 years, Jesus shortened the time.

Does God Know When We Will Die?

The Bible says God is all-knowing, but does that mean He knows our future and we have an appointed time to die? Let’s examine the thought and its implications.

What Does The Bible Say About Praying For Others?

We can pray for others, and the Bible actually encourages us to do so. Even the Disciples and other Biblical writers asked for prayers in their time of need.

Make sense of the news

Christian commentary

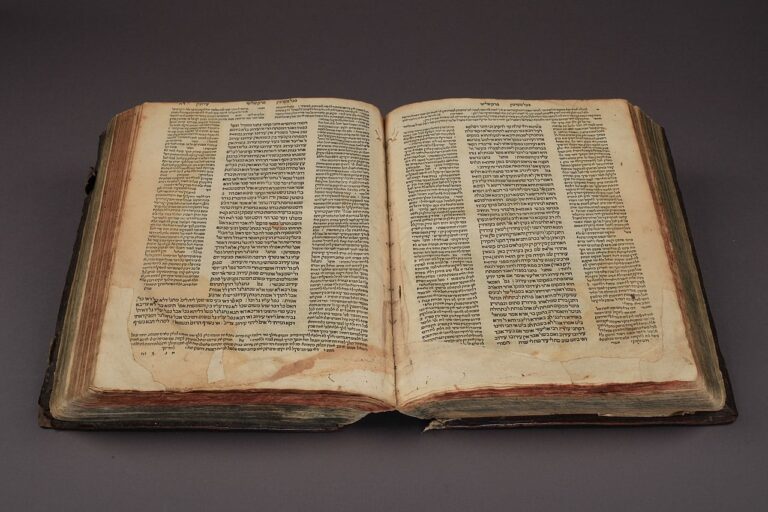

Talmud: The Dangers Of Judaism

We commonly hear, the Jews are God’s chosen people, and Judeo-Christian values bind us together. So what does the Talmud say about the values of Judaism?

This Is Why God Destroyed His Vineyard

Do you ever wake up, crank up the news and think, what the heck happened? I mean what happened to sensibility, common sense, and decency?

God, Are We Even Worth Saving?

It’s an honest question. Our world is pretty messed up these days. When our leaders are not messing up the world, or reaping profits and power for themselves, then it’s us who pervert the world.